Venture capital (VC) represents an exciting intersection of finance and entrepreneurship, filled with opportunities for impactful work, personal development, and big rewards. If you want to join this dynamic industry, let me share my experience and insights.

As a tech entrepreneur, I've pitched and made friends with hundreds of VCs for over nine years. Throughout my entrepreneurial journey, I've raised several million in funding for my ventures and advised numerous founders on capital raising, product development, and growth strategies.

In this comprehensive guide, I'll draw upon my experiences and industry knowledge to give you the insights you need to start your venture capital journey. Join me as I share practical advice, tips, and strategies to help you navigate the venture capital world and position yourself for success.

Venture capital is a unique field that funds the dreams of entrepreneurs and shapes the future of industries. But what does a venture capital career look like? Let's dive in.

Venture capital is a type of private equity financing that investors provide to startups and small companies believed to have long-term growth potential. In short, nearly all the most popular, world-change technology companies took some form of VC investment in their lifetime.

Venture capitalists work for a VC firm or fund and invest in innovative, early-stage companies in exchange for equity to generate significant returns as they grow and become more valuable. Also most Venture capitalists aren't merely passive investors. They take a hands-on approach, often guiding companies on business strategy, operations, and growth plans. They have the power to influence industries, shape trends, and enable the growth of startups that can transform the world.

Venture capital is crucial in addressing the funding gap for high-risk, innovative startups. It predominantly supports early-stage companies with high growth potential and disruptive ideas. This funding is typically received by entrepreneurs and founders who demonstrate promising business models and scalable ventures.

A venture capital firm usually has a well-defined hierarchy. Let's look at the typical roles within a VC firm:

1. Analyst: This is often the entry point for many venture capitalists. Data analysts conduct market research, source potential investment opportunities, and support due diligence efforts.

2. Associate: Associates typically work above analysts and are involved in deal sourcing, due diligence, and often, portfolio management.

3. Principal or senior associate: Professionals in this role have usually gained considerable experience and demonstrated a keen understanding of the investment landscape. They are heavily involved in deal execution and portfolio management.

4. Partner: Partners are the decision-makers within the firm. They source deals, lead investment decisions, manage investor relationships, and steer the firm's direction.

Besides these primary roles, there are Venture Partners, Entrepreneurs in Residence (EIRs), and other positions that contribute valuable industry expertise to the firm. Limited Partners (or LPs) is another term you might hear. These are often the investors in the venture capital funds that the VCs manage.

Read more: Breaking into venture capital part 1

A career in venture capital can come with considerable benefits, such as:

However, a VC career also comes with its set of challenges. These include:

To understand the power and influence of a successful venture capitalist, it's worth looking at some of the industry pioneers:

Fred Wilson of Union Square Ventures-backed Twitter and Zynga, demonstrating social media's and online gaming's potential. His blog, AVC, offers valuable insights into his investing philosophy and the VC industry. He emphasizes staying curious and never underestimating the power of technological disruption.

For those seeking to break into the industry, Wilson recommends building a "network before you need it." He believes that networking, even if it seems unnecessary at the time, can open up opportunities down the line, especially in a relationship-driven industry like venture capital.

Peter Thiel was a co-founder of PayPal and an early investor in Facebook through his VC firm, Founders Fund. His contrarian thinking, captured in his book "Zero to One," challenges conventional wisdom in venture investing.

Thiel often emphasizes the importance of finding and investing in genuinely unique companies that can't be easily replicated and is famous for coining the phrase ‘Competition is for losers.’ Thiel stresses the importance of understanding technology for anyone looking to break into venture capital.

His advice for aspiring VCs is to spend time working at a startup to gain operational experience, as this can provide unique insights into how successful businesses grow and function.

Bill Gurley of Benchmark Capital backed companies like Uber and Zillow. His long-form blog posts on "Above the Crowd" delve into complex industry topics and investment strategies. Gurley suggests that those looking to break into VC should focus on understanding business fundamentals.

He argues that having a solid grasp of how businesses operate, the dynamics of different markets, and the financial mechanics behind startups are crucial skills for anyone aiming to succeed in venture capital.

These pioneers underscore the fact that venture capital isn't a one-size-fits-all industry. It requires a mix of skills and qualities, including curiosity, an understanding of technology and markets, networking abilities, and a deep comprehension of business development and mechanics.

Success in VC often comes from thinking differently, whether investing in new trends or seeking out unique, disruptive companies. Their success stories underscore the influence, wealth, and intellectual fulfillment a career in venture capital can offer.

Read more: Breaking into venture capital part 2

Venture capital offers a clear career pathway from entry-level positions to leadership roles. While the journey isn't easy, understanding the path can help aspiring VCs navigate their careers more effectively.

The traditional VC career path usually begins at the analyst level. Analysts are typically recent graduates or professionals with a few years of experience in related fields like investment banking, management consulting, or startups.

As an analyst, you'll research industry trends, identify potential investment opportunities, and support due diligence efforts. This role provides an excellent foundation for understanding the mechanics of venture investing.

With experience, analysts can progress to the associate role, where they'll have more responsibility for sourcing deals and managing relationships with startups.

After several years as an associate, you may advance to a principal or senior associate position. In these roles, you'll have considerable influence over investment decisions and often take the lead in managing portfolio companies.

Finally, after demonstrating a consistent ability to source successful deals and add value to portfolio companies, you may have the opportunity to become a partner.

As a partner, you'll significantly steer the firm's investment strategy, manage relationships with limited partners (the investors who provide capital to the VC firm), and mentor junior team members.

While the analyst-to-partner path is common, there are other roles within a venture capital firm. Often less formal, these roles offer unique ways to contribute to a VC firm's success.

1. Venture partner: Venture partners are often industry veterans who work part-time with a VC firm. They help source deals and provide valuable industry insights, but they usually have a different level of commitment than full-time partners.

2. Entrepreneur in residence (EIR): EIRs temporarily work with a VC firm. They offer practical entrepreneurial insights and may work on starting a new company during their tenure at the firm.

3. Operating partner: Operating partners have specific industry or functional expertise (like sales, marketing, or product development) and work with portfolio companies to help them grow.

While the traditional venture capital career path from analyst to partner is well-trodden, the industry has many diverse roles. These alternative paths offer unique ways to contribute to a VC firm's success and allow for a more flexible commitment to the industry.

Whether you're an industry veteran, a successful entrepreneur, or a functional expert, there's a place for you in venture capital. Embracing these non-conventional roles can provide enriching experiences and contribute to your professional growth in this dynamic industry.

Read more: Four lessons I learned from starting a $10M+ company 🚀

Salary in venture capital varies widely depending on the VC firm's role, experience level, location, and performance.

According to data from Wall Street Oasis, U.S. VC professionals could expect to see the following average annual compensation ranges:

These figures include base salary, bonuses, and carried interest (aka Carry, a share of the profits from the firm's investments). Carry could be less or much more (imagine you invested in Uber or Facebook’s seed round!). The average base salary for venture capital professionals in the United States typically ranges from $80,000 to $200,000, depending on the role and experience level.

Bonuses can also be significant and add another $50,000 to $100,000 to the compensation package. Some additional factors can affect venture capital salaries:

The figures can vary significantly based on location. VC salaries in burgeoning tech hubs like London, Berlin, or Singapore might be lower than in Silicon Valley, but they still offer competitive compensation given the local cost of living.

Sarah Tavel initiated her venture capital journey as an Investment Associate at Bessemer Venture Partners. Here, she honed her skills in evaluating investment opportunities and understanding the dynamics of the startup ecosystem.

But Tavel’s growth didn't stop within the traditional venture capital realm. Her career took an exciting turn when she immersed herself in the operational side of startups.

After spending four years at Bessemer, Tavel joined Pinterest in its early stages, shifting her role to product management. This switch allowed her to deepen her understanding of startups' real-time challenges, from product development to scaling operations.

This unique perspective gained through first-hand operational experience is precious in venture capital, where understanding the startup journey from the inside can inform investment decisions and portfolio management.

Returning to venture capital, Tavel assumed the role of a Partner at Greylock Partners. Her combined operational experience and venture capital expertise make her an asset in her role. Eventually, she joined Benchmark Capital as a General Partner, marking a significant milestone in her venture capital career.

Reflecting on her journey, Tavel once noted, "The most important thing in venture capital is to have an opinion and a point of view." She emphasizes the importance of conviction and making informed decisions even in uncertainty — an essential trait for venture capitalists.

Tavel has often spoken about the power of 'intellectual curiosity,' stating, "It’s our job to learn, it’s our job to be curious, it’s our job to understand deeply different spaces." For those aspiring to break into venture capital, this underscores the importance of continuous learning and a deep interest in understanding diverse industry sectors.

Sarah Tavel's journey from an entry-level position to a General Partner paints an inspiring picture of the potential for career progression in venture capital.

Her trajectory also highlights the immense value that operational experience in a startup can bring, adding a layer of practical insight to the theoretical and strategic knowledge inherent in venture capital roles.

Read more: 7 easiest ways to validate your startup product idea (with metrics)

Tavel’s story is just one pathway. Breaking into venture capital isn't easy, but understanding the more common pathways can significantly enhance your chances and streamline your journey into the industry.

An MBA from a top-tier business school has traditionally been one of the most common routes into venture capital. A program focusing on entrepreneurship or private equity can provide valuable skills, while networking opportunities can lead to potential job opportunities.

However, an MBA is not the only educational path to venture capital. Other degrees, such as a Master's in Finance or a technical degree in a relevant field (like computer science, data science, or artificial intelligence for tech-focused VC firms), can be valuable.

In the digital age, online courses offer another way to learn about specific skills in venture capital. Platforms like Coursera and Udemy offer courses on venture capital for beginners.

For example, the "Venture Capital Course: The Definitive Guide to Raising Start-Up Capital" on Udemy might be helpful for Founders raising funds. At the same time, "Venture Capital and the Finance of Innovation" on Coursera delves into the specific skills of financial modeling.

Unlike other specific VC courses, EntryLevel provides a comprehensive VC course, a complete 101 on becoming a venture capital analyst. The course is taught by industry leaders and focused on hands-on practical modules.

The course covers the A-Z of venture capital, from analyzing investment opportunities to understanding the intricacies of deal structuring. It offers an all-encompassing view of the venture capital landscape, making it a valuable resource for those serious about breaking into the field.

Real-world experience is critical in venture capital. One way to gain experience is through cohort-based courses like the VC Career Course offered by GoingVC or the 6-week EntryLevel program mentioned earlier. Courses like these cover theory with practical exercises like sourcing startups, conducting due diligence, and structuring deals.

Another practical way to learn is by starting as an angel investor. Platforms like AngelList and SeedInvest allow individual investors to participate in early-stage financing rounds. While the financial risk is real, the learning and networking opportunities can be significant.

In venture capital, who you know can be as important as what you know. Networking is crucial for breaking into the industry and sourcing deals once you're in. Attending industry events, joining VC-related groups on LinkedIn, and connecting with industry professionals can help you build your network.

Mentorship is another powerful tool. A mentor who is an experienced venture capitalist can provide guidance, advice, and, potentially, introductions to job opportunities. Here are four tips to help your networking efforts:

1. Attend industry events: Participate in startup events, VC conferences, and industry meetups. These are excellent places to meet venture capitalists, entrepreneurs, and like-minded individuals. Make it a point to engage in meaningful conversations and follow up afterward.

2. Leverage LinkedIn: LinkedIn is a powerful tool for connecting with industry professionals. Make sure your profile is up-to-date, and use it to reach out to venture capitalists or alumni from your college who work in the industry. Be genuine, express your interest, and propose a way to provide value.

3. Build thought leadership: Start a blog, write about trends in the industry, or share your thoughts on recent VC deals on platforms like Medium or Twitter. This will demonstrate your passion and knowledge and attract attention from industry insiders.

4. Get involved in the startup ecosystem: Volunteer or work part-time at a startup or in a startup incubator or accelerator. This offers a valuable opportunity to meet VCs mentoring or investing in these startups.

Venture capitalists need a range of skills and traits to succeed. Mastering the traits VC firms seek in their team members is essential to success in the venture capital world.

Market trends, financials, and business models are crucial in venture capital. Challenge your analytical thinking - this could involve solving complex problems, learning financial modeling, or looking at market research and studying trends.

Venture capital is a people business. Building relationships with entrepreneurs, co-investors, and team members is essential. Improve your communication skills by expanding your network, finding mentors, and improving your listening skills. Volunteering for leadership and management roles can also help.

Whether convincing entrepreneurs to accept your firm's investment or persuading limited partners to invest in your fund, sales skills are vital. Develop this skill in daily life: convince a friend to try a new place, negotiate a good deal, or stand up for your ideas at work.

Venture capital involves many rejections and failures. Resilience is critical to enduring the ups and downs. To be more resilient, practice mindfulness, stay positive, and see failure as a chance to learn.

A genuine passion for innovation and entrepreneurship can differentiate you in a competitive field. Keep your love for new ideas alive. Stay informed about industry trends, attend tech meetups, and try new technologies and products.

Read more: 9 best venture capital online courses to take in 2023 (with certificates)

Many venture capitalists follow the traditional route, but there are other ways. In this section, we'll explore alternative pathways into venture capital.

Successful entrepreneurs have firsthand knowledge of building and scaling companies. This can make them attractive candidates for venture capital firms, as they can offer practical advice and guidance to portfolio companies.

Consider the case of Chris Sacca, a former Google executive who started as an angel investor and then founded Lowercase Capital. Sacca's entrepreneurial and operational experience allowed him to spot potential in companies like Twitter, Uber, and Instagram, yielding significant returns.

"Your value doesn't decrease based on someone's inability to see your worth." This quote by Sacca emphasizes the importance of self-confidence and belief in your abilities when trying to break into venture capital, even in the face of rejection or criticism.

Technical professionals, such as engineers or data scientists, can offer valuable insights to VC firms, particularly those investing in tech or biotech startups.

Mary Meeker, a partner at Bond Capital, started as a Wall Street analyst covering technology companies. Her deep understanding of tech trends and her famous "Internet Trends Report" have made her one of Silicon Valley's most respected venture capitalists.

"Investing in growth is not an option, but an imperative." This quote by Meeker underscores the importance of being forward-looking as an investor, always seeking opportunities that promise significant growth and have the potential to transform industries.

Consulting and investment banking provide a strong foundation for a career in venture capital. These professions offer skills in financial and market analysis, deal structuring, and strategic thinking, which are valuable in venture capital.

Scott Kupor, the managing partner at Andreessen Horowitz, began his career as a project manager at Silicon Graphics and became a management consultant at Credit Suisse. His diverse experiences gave him a broad skill set that he leverages as a venture capitalist.

"To be a good VC, you have to have a genuine curiosity about the world and how it can be made better through innovation." This quote by Kupor stresses the importance of inquisitiveness and a passion for innovation in the venture capital industry.

Internships and fellowships offer another pathway into venture capital. Many VC firms offer internship programs that provide a hands-on introduction to venture capital.

Fellowship programs, like the Kauffman Fellows Program, provide structured training and mentorship for aspiring venture capitalists. Startmate, an Australian and New Zealand-based accelerator, also has a Fellowship.

Startmate’s Fellowship program offers a unique opportunity to learn from some of the region's best entrepreneurs, investors, and executives designed for individuals at all stages of their careers who are keen to move into the world of startups. Programs like these can be a good stepping stone to a full-time role in venture capital.

Despite the sometimes competitive landscape of breaking into VC, whether you choose the traditional route through education and finance roles or leverage unique experiences as an entrepreneur or technical professional, there are many paths into the industry.

With determination, resilience, and a commitment to continuous learning, you can chart your own course in the exciting world of venture capital.

Read more: Ask a CEO anything with Ajay Prakash, CEO and Founder of EntryLevel

Success in venture capital requires a blend of hard and soft skills (like the ones mentioned earlier). In this section, let's look at some of the hard skills you might need.

A firm grasp of business models and financials is crucial. You'll need to understand different revenue models, cost structures, and critical metrics for different types of businesses. You'll also need to be comfortable reading and interpreting financial statements, modelling financial projections, and valuing companies.

You could also make it a habit to dissect business models daily. Take any product you love and try to understand its business model; think about its revenue, cost structures, and key metrics that would indicate success.

Courses in finance, accounting, and business strategy can help build these skills, or one like EntryLevel’s 6-week VC Analyst course could also give you a solid foundation.

Venture capitalists need to stay on the cutting edge of industry trends. This means constantly learning about new technologies, business models, and market dynamics.

Reading industry news, attending conferences, and networking with entrepreneurs and other VCs can help you stay informed. You can also follow influential venture capitalists, and industry thought leaders on social media and subscribe to newsletters like "StrictlyVC" or "Inside Venture Capital."

The AVC blog by Fred Wilson is also fantastic, and publications like TechCrunch, VentureBeat, and Tech In Asia are good resources to keep up to date with funding announcements. There are also country-specific publications that can offer unique insights, such as the following:

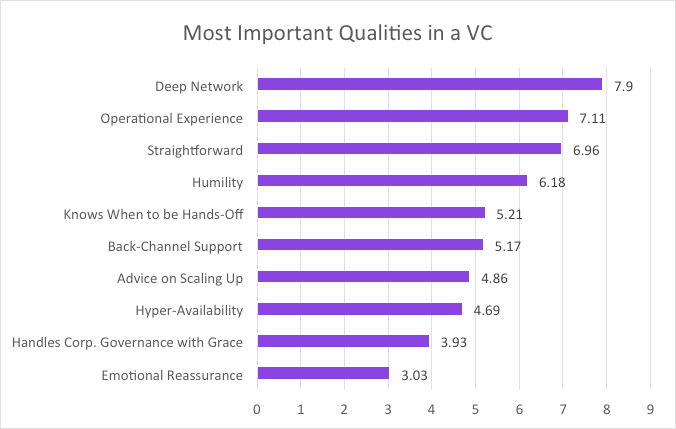

Venture capital is a people business. Effective networking can help you source deals and build relationships with early-stage entrepreneurs and investors. This requires a deep understanding of markets and connections with investors in different countries, as illustrated by the image below for various VC investments.

Negotiation skills are essential for structuring deals and resolving conflicts. You'll also need strong communication skills to present your ideas persuasively and clearly. It's essential to take into account the importance of these soft skills. Practice them constantly, as they'll open doors in venture capital and any industry you may venture into.

Having an online presence and building a personal brand can help you stand out in a competitive field.

An active online presence, through blogging, social media, or podcasting, can showcase your knowledge, interests, and personality. It can also make you more visible to potential employers, entrepreneurs, and co-investors.

Your personal brand is more like a professional signature in the digital world. Start small and authentic, sharing your thoughts on an industry trend or a book you've recently read, and let it evolve organically.

Ryan Hoover is an excellent example of this: he founded Product Hunt, which Angel List acquired, and moved into angel and VC investing.

This could be posting more on LinkedIn, podcasting, writing on Substack, or other things. Remember, the goal is to offer value and share a unique perspective. Quality thinking is critical as an investor.

Read more: Venture capital Q&A (watch a video with Caleb Maru, the General Partner at Proximity Ventures)

Location can play a significant role in your venture capital career. Let's explore how different regions shape the VC landscape, and remember, choosing a location is a strategic decision - be mindful of your career goals, industry focus, and lifestyle preferences.

Tim Ferris recently discussed his strategy for building a network on Huberman’s podcast from scratch. He mentions that choosing where you live is one of the most significant decisions.

Silicon Valley has long been the epicenter of venture capital. The concentration of tech talent, startups, and VC firms creates a dynamic ecosystem where deals, collaborations, and innovations happen rapidly.

Working in Silicon Valley can offer exciting opportunities but is also a competitive and high-cost environment. It's an ideal place for those who thrive in a high-stakes, fast-paced environment where cutting-edge tech trends are set (but not the only place).

While Silicon Valley remains influential, venture capital is increasingly a global phenomenon. Cities like London, Berlin, Shanghai, and Bangalore have thriving VC ecosystems. Each region has unique characteristics, opportunities, and challenges.

For example, European VCs may have to navigate different regulatory environments across EU countries. In contrast, Asian VCs may focus on sectors like e-commerce or mobile gaming that are particularly strong in that region.

Embrace the global mindset and consider the unique opportunities each region offers. The key is to match your interests, be it a particular sector or a regional market, with the right location.

The COVID-19 pandemic has accelerated the trend toward remote work. This is reshaping the venture capital landscape, as VCs are increasingly open to investing in startups outside their immediate geographies. It also means that working in venture capital may not require living in a traditional VC hub.

This shift broadens the scope of opportunities and invites a more diverse talent pool into the industry. Embrace this flexibility and look for roles beyond geographical constraints if you need help packing and moving to the Valley.

Salaries in venture capital can vary significantly by location. A VC in Silicon Valley might earn a higher salary than a counterpart in Berlin, but they'll also face higher living costs. When considering location, it's important to weigh salary against cost of living and quality of life factors.

Consider the entire package, including the living costs, work-life balance, personal growth opportunities, and cultural experience each location offers. It's about finding a balance that works for you.

Read more: Startups and venture capital advice

Venture capital is an ever-evolving field. Keeping abreast of trends could be instrumental in spotting investment opportunities ahead of the curve. Or even better yet, having enough conviction to be willing to go against the crowd. After all, to quote Thiel again, he says the best returns are about being ‘non-consensus, but right.’

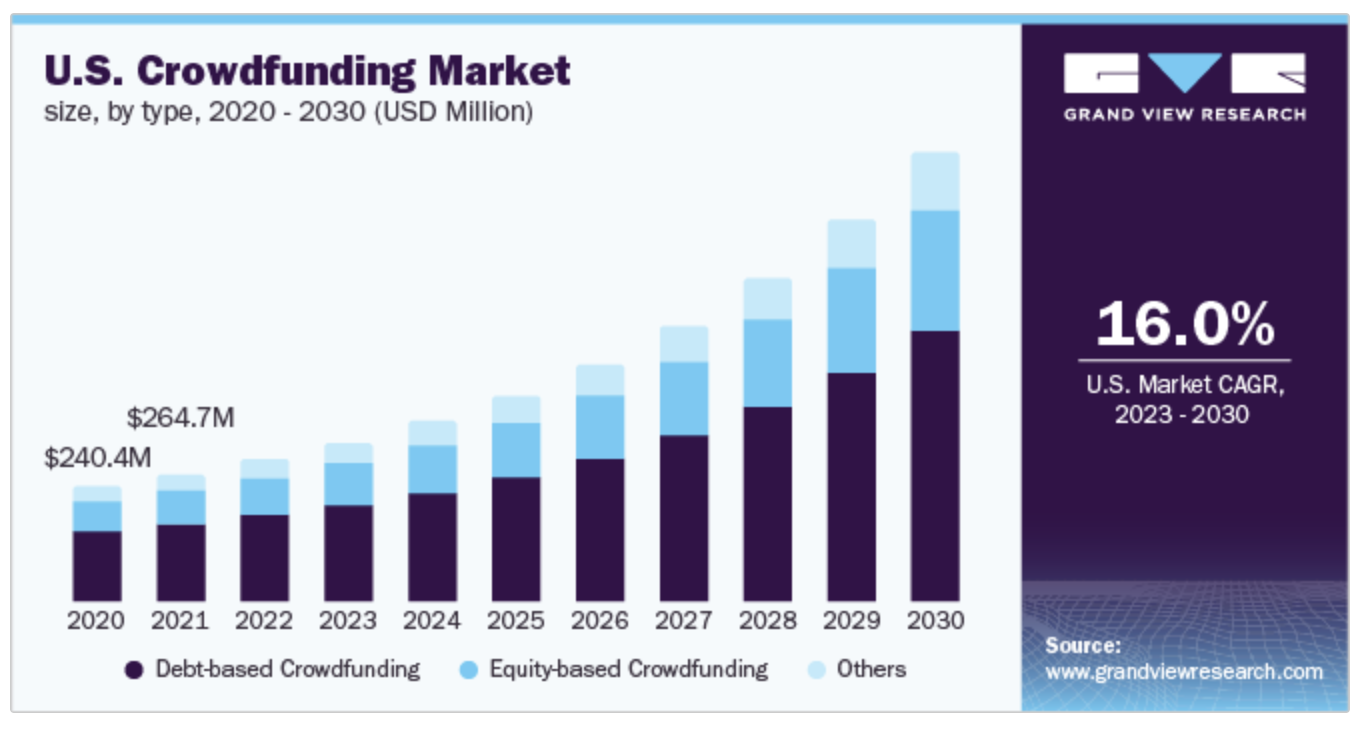

New models of venture capital are emerging. Corporate venture capital (CVC), where corporations invest in startups, is rising. Impact investing, which targets companies that generate social or environmental benefits alongside financial returns, is gaining momentum.

Crowdfunding platforms allow individual investors to participate in early-stage startup financing, traditionally dominated by VCs.

As an aspiring VC, understanding and adapting to these new investment models can add versatility to your investment toolbox and open up new paths to capital (showing you’re up-to-date with your thinking and willing to think outside the box).

The venture capital industry has been criticized for lacking diversity. However, there's growing recognition of the value of diverse perspectives in driving innovation and financial performance.

Firms are increasing diversity among VC partners and within their portfolio companies. For aspiring VCs, this could open new opportunities and perspectives.

Embrace this shift by seeking diverse experiences, fostering inclusive practices, and championing diversity in your networks. Ultimately, it’s becoming increasingly clear that diverse people with different ways of thinking often lead to better decision-making.

Emerging technologies like cryptocurrency, blockchain, and artificial intelligence (AI) create new opportunities and challenges for VCs. Crypto and blockchain could disrupt traditional financial systems and business models (The jury is still out on this, but it’s no denying it was a big theme of 2021).

According to a report by Galaxy Digital, venture capitalists invested over $33 billion into crypto and blockchain startups in 2021. With VCs investing just over $12 billion in the sector the previous year, it shows how quickly sentiment can shift and how fast capital can rotate in and out of industries in the world of tech investing.

As we stand on the brink of an AI revolution, it's crucial to understand that this transformative technology is not just reshaping industries like healthcare and transportation, it's also redefining the future of venture capital as we witness a platform shift arguably bigger than when the iPhone was first released in 2007.

The year 2023 is anticipated to witness an unprecedented injection of capital into AI, highlighting the importance and potential it holds. Unlike other emerging technologies such as blockchain, the immediate and tangible value delivered by AI is undeniable, demonstrated by innovative applications like ChatGPT, Google Bard, Bing, and a myriad of other apps being built on top of these powerful Large Language Models (LLM’s). Staying educated about these technologies, their evolution, and their potential impacts is now a non-negotiable for any aspiring venture capitalist. The unique use cases and value propositions that AI offers could well be the key to unlocking novel investment opportunities and strategies.

Venture capital is a high-stakes industry, and several ethical considerations must be considered. Some key ethical challenges in venture capital include the following:

Venture capitalists often have multiple investments, and it can be difficult to avoid conflicts of interest. For example, a venture capitalist might invest money in a company that is competing with another company in which they have a financial interest.

Venture capitalists often have access to confidential information about their investment companies. This information asymmetry can create ethical challenges, as venture capitalists must be careful not to misuse this information.

Venture capitalists have a fiduciary responsibility to their investors. This means that they have a legal and ethical obligation to act in the best interests of their investors. This can be a challenge, as venture capitalists often must make difficult decisions between their duty to investors, which conflicts with the interests of the founders and startups they’ve invested in.

VC’s need to strike that balance between ensuring they make ethical decisions that will benefit their investors, the companies they invest in, and society.

Read more: 7 easiest ways to validate your startup product idea (with metrics)

What does it take to succeed in venture capital? Let's explore some habits and mindsets of successful VCs. Successful VCs tend to share certain traits and habits:

An effective way to foster these habits is to dedicate daily time to learning and reading, develop your critical thinking skills, embrace challenges as opportunities for growth, and consistently engage with your network.

In venture capital, relationships are key. Building strong relationships with entrepreneurs can give you access to the best deals.

Good relationships with co-investors can lead to syndication opportunities. And inside your firm, strong relationships can help you navigate the politics and dynamics of the partnership.

Keep in mind that building these relationships takes time. Prioritize genuine connections, provide value before asking for it, and maintain these relationships even when there's no immediate gain.

Venture capital is about more than making money. It's about fueling innovation and helping entrepreneurs realize their visions. The most successful and fulfilled VCs are those passionate about the startups they invest in and the entrepreneurs they work with.

To create a fulfilling career, remember that being a VC and investor can take many forms. Align your VC activities with your interests and values. Cultivate a deep interest in your investing areas and develop sincere relationships with entrepreneurs.

When you're passionate about your work, not only will it lead to success, but it will also bring immense satisfaction and impact.

Read more: A 5-step guide to breaking into tech in 2023: with no coding needed

Here are some valuable resources to deepen your understanding and gain insights into the world of venture capital, guiding you on your journey to becoming a successful VC.

The journey into venture capital is a marathon, not a sprint. Be patient, stay curious, and always be learning.

Venture capital is a challenging but rewarding career path. It offers the opportunity to be at the forefront of innovation, to work with inspiring entrepreneurs, and to shape the future of industries.

Whether you're just starting your career or looking to transition from another field, the journey into venture capital is an adventure that's full of learning, growth, personal development, and excitement.

1. Enrol in a course on venture capital: This can provide a solid foundation of knowledge and skills. Check out venture capital courses on EntryLevel.

2. Network: Start building relationships with industry professionals. Attend industry events, join LinkedIn groups, and reach out to people already in the field.

3. Stay informed: Follow industry news, trends, and thought leaders. Subscribe to newsletters, follow VCs on Twitter, and read VC, investing, and tech blogs to improve your thinking.

4. Gain experience: Look for internships, fellowships, or entry-level venture capital roles. Consider starting as an angel investor or working at a startup to gain practical experience.

5. Embrace cohort-based education: Find practical courses that help you build a portfolio to show your ‘proof of work’ and abilities.

Check out our Venture Capital Analyst Fundamentals to learn more about our active community support (over 2,292+ peers on Discord), certification of completion, hands-on project work, learning outcomes, and why the program is amazing.

Aspiring investors should learn about finance strategy, business development, startup valuation, and the role of angel investors in startup funding as the foundations of venture capital.

Investment management principles guide investment decisions, risk assessment, and due diligence in venture capital. They help investors identify opportunities and diversify portfolios within the VC ecosystem.

Leadership and management in venture capital require financial acumen, business strategy expertise, and the ability to identify and support promising startups. Understanding the VC ecosystem, digital transformation, and emerging technologies can be advantageous.

Project management ensures the smooth execution of investment processes, deal sourcing, due diligence, and post-investment activities in venture capital. It involves coordinating stakeholders and resources to achieve investment objectives.

Venture capital supports startup funding through capital, mentorship, and industry connections. VC firms invest money in early-stage companies, helping them overcome financial barriers and scale their operations.

Startups are valued based on growth prospects, market potential, team expertise, revenue projections, and competitive advantage in the venture capital ecosystem. Valuation methods include discounted cash flow and market comparables.

Key considerations for venture capital investors include evaluating market potential, conducting due diligence, assessing team capabilities, analyzing business models and strategies, and understanding potential returns on investment.

Limited partners (LPs) provide capital to venture capital funds. They contribute to portfolio diversification and sustainability, aligning their interests with the success of the VC firm.

Machine learning (ML) enables data-driven investment decisions in venture capital. It helps analyze large amounts of data, identify patterns, and optimize market trend analysis, due diligence, startup screening, and portfolio management.

Managing partners and directors oversee overall venture capital operations, including fundraising, deal sourcing, investment decision-making, portfolio management, and investor relations. They provide strategic guidance based on their expertise in finance, business development, and the VC ecosystem.

Author: Edwin Onggo

Edwin Onggo has pitched and made friends with 100’s of VC’s as a tech entrepreneur for more than 9 years. He’s raised several million in funding and advised a number of founders with their capital raising, product, and growth strategies.

He is also currently the Head of Growth and Product at EntryLevel.